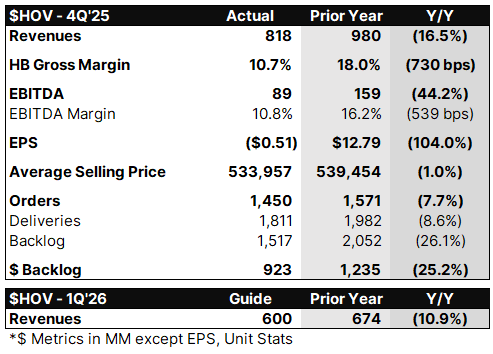

As we frame our preview for the Toll Brothers earnings print this afternoon, we start with a quick look at last week’s results from underfollowed public homebuilder Hovnanian (HOV):

Yes, it was an unmitigated disaster up and down the P&L - gross margins -730bps Y/Y with an unexpected earnings loss and backlog of contracted homes declining 25%.

Shares, which touched ~$240 about a year ago, now sit at ~$98 after the 20% single-day decline and additional follow through today (-5%).

With this set of results in mind, take a look at where the TOL valuation sits into this afternoon’s print relative to the last few years of quarterly earnings history: