Tuesday’s earnings slate is chock-full of important names for housing - almost all of which are trading at all time high valuations. This post outlines why we are about to retrace lower across the home construction landscape (the retrace already began with a vengeance across housing services and resale names: Zillow, Compass, Rocket, PennyMac, etc.).

Take a look at who we hear from and where they currently stand in historical context - all of these names are flashing red in the valuation column:

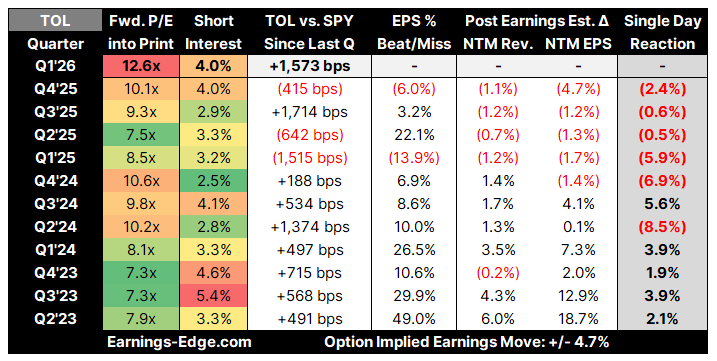

Toll Brothers (TOL) - The highest end of production homebuilding (ASPs ~$1M)

Tuesday’s earnings slate is chock-full of important names for housing - almost all of which are trading at all time high valuations. This post outlines why we are about to retrace lower across the home construction landscape (the retrace already began with a vengeance across housing services and resale names: Zillow, Compass, Rocket, PennyMac, etc.).

Take a look at who we hear from and where they currently stand in historical context - all of these names are flashing red in the valuation column:

Toll Brothers (TOL) - The highest end of production homebuilding (ASPs ~$1M)

Somehow Toll Brothers is about to trade into earnings at or close to a new all time high, both in price, and, for the cycle, valuation. 12.6x forward earnings prices in a big, new housing boom at the high end of the production homebuilding spectrum. Do we really think that’s about to kick-off? We’ve heard whispers about housing policy initiatives under Trump, but the all important Spring Selling Season is about to kick-off without any official support. We’re not even certain that the policy slate will be accretive for the builders (anti-trust actions have been discussed in media; forcing supply would likely hurt builder margins).

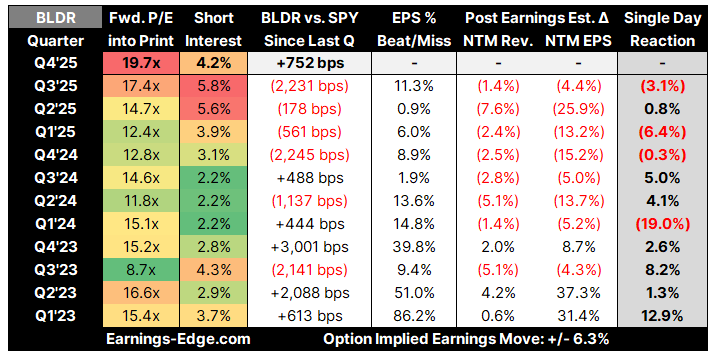

Builders FirstSource (BLDR) - The largest distributor of housing framing lumber

Builders FirstSource would be one of the primary beneficiaries of the rumored ‘one million Trump homes’ of supply. Whereas builders themselves would likely take a hit on their profit margins by ramming through a boatload of new supply, Builders FirstSource supplies the framing lumber and related products into those homes and would benefit materially on a volume surge. That said, with nothing official, the Builders FirstSource outlook will likely disappoint - especially if the Taylor Morrison unit sales forecast guide-down is representative of the broader homebuilding landscape for 2026.

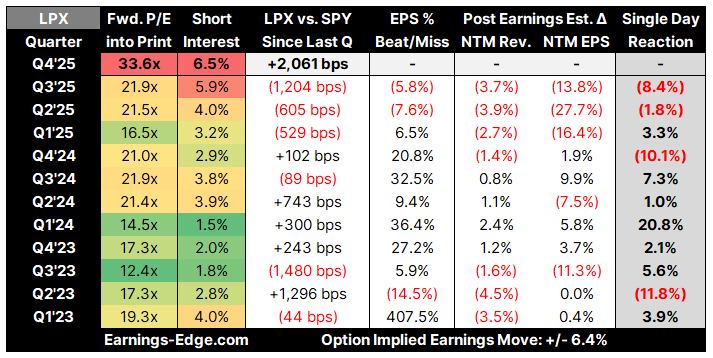

Louisiana-Pacific (LPX) - Engineered wood products sold into housing construction

The commentary applicable to Builders FirstSource is also applicable to Louisiana-Pacific as Louisiana-Pacific is a major beneficiary in a supply side housing boom. Again, though, nothing official from the Trump admin (along with at least one partial denial from Bill Pulte), and the last builder report of note (TMHC) guided down 2026 supply estimates.

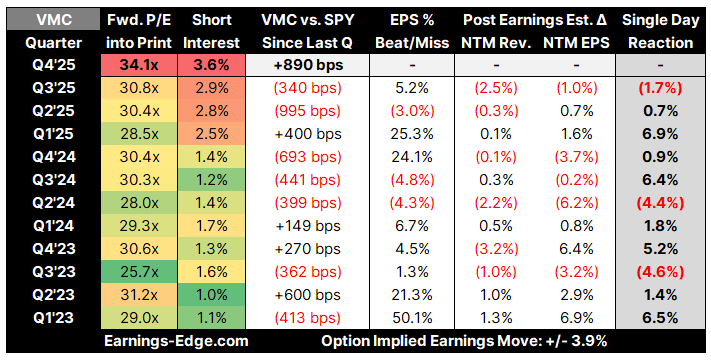

Vulcan (VMC) - Construction aggregates necessary for every housing development

Again, same commentary as above for Builders FirstSource and Louisiana-Pacific. Please note, though, that Vulcan’s residential sales are relatively limited (20-25%). Please also note that peer Martin-Marietta just reported with a -7% reaction (de-risking the Vulcan earnings somewhat).

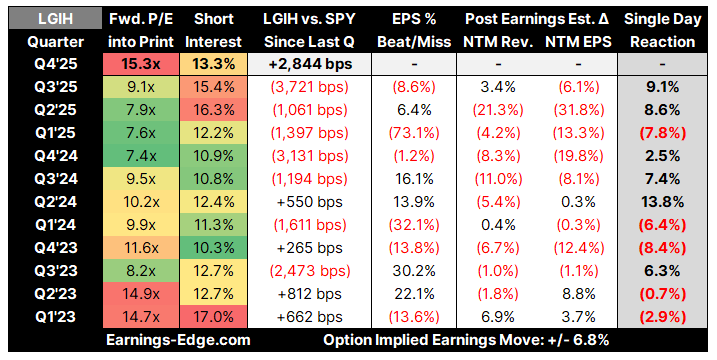

LGI Homes (LGIH) - The low end of production homebuilding (ASPs ~$360k)

Toll Brothers, but for lower income folks. Yes, the valuation looks very stretched here, but, unlike Toll, LGI is well off of all time high levels. Given its small size, LGI is not very important for the broader housing construction market.

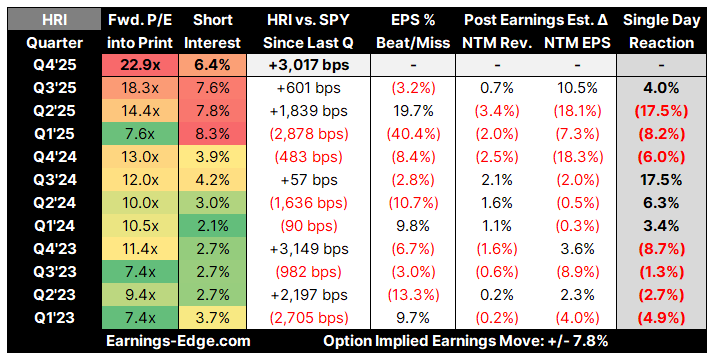

Herc (HRI) - Construction equipment rentals

Residential exposure is relatively small, but another name selling into housing construction that is flashing as overbought.

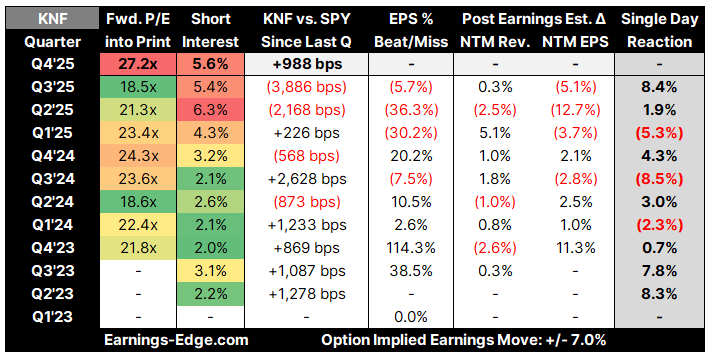

Knife River (KNF) - Construction aggregates for housing developments

A baby Vulcan but in slower growth markets. Not important but never more expensive.

Why will all of these red-hot, overbought housing construction names reporting on Tuesday force a retrace lower for the industry? First, the bar is too high in almost every case given what we know about the 2026 homebuilding outlook. Second, much of what we have seen over the last few weeks has been flow driven: capital forced out of tech + momentum and into value + industrials + hard assets (here land ownership). Fundamentals have NOT improved, and future policy initiatives are actually likely a net-negative for homebuilders (and won’t even arrive until the 2027 construction slate).

I’ll close this piece noting that there are a few other housing names reporting on Tuesday, but none of which are either important or flashing warning signs of being overbought:

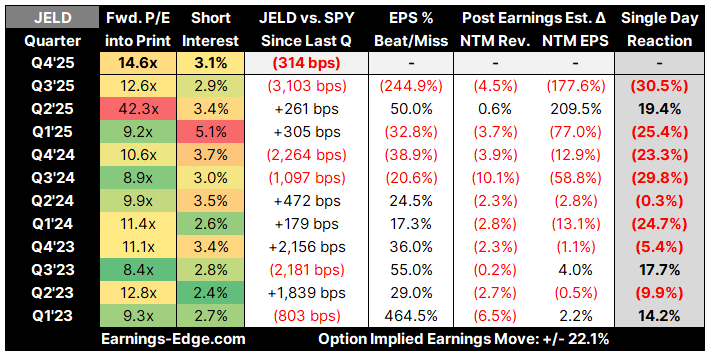

Jeld-Wen (JELD) - Distressed member of the US door manufacturing duopoly

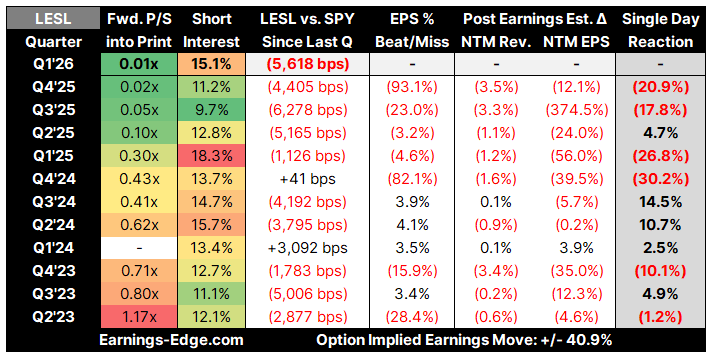

Leslie’s (LESL) - Distressed pool supply retailer / distributor

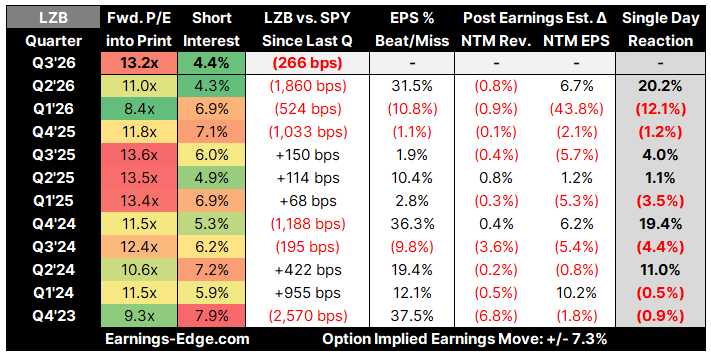

La-Z-Boy (LZB) - A glimpse into furniture (although not very representative)