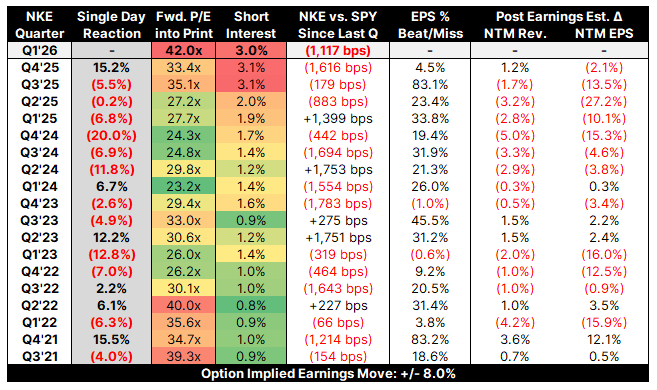

In some respects, Nike feels a lot like Starbucks - trading at an astronomical earnings multiple anticipating a turn around that may or may not be coming anytime soon. How did that work out for Starbucks investors? Not well… Here’s the historical context for Nike into today’s print:

As seen above, earnings revisions have been trending lower for seven straight quarters - does that come to an end today? The valuation (42x forward earnings) indicates that investors think the answer is yes. The stock should be punished if the opposite is true.

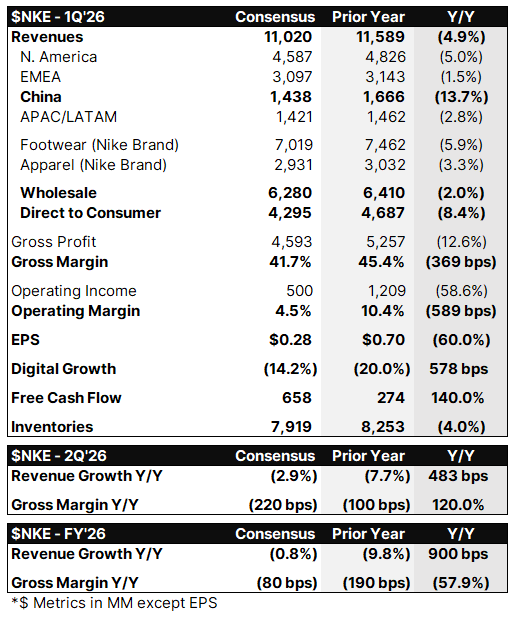

Below you’ll find Consensus expectations for 1Q, 2Q and FY’26:

We’ll have a full Consensus recap emailed to you ASAP following today’s release.